Home buying can be a confusing, convoluted process but we find that it is much more manageable if you break it down into our 8-Step Home Buying Process. If you have any questions regarding any specific step in the process please contact us for more information:

Step 1: Determine Your Wants and Needs

Step 2: Select a Real Estate Professional

Step 3: Apply for Loan Pre-approval

Step 4: Shop for Homes

Step 5: Select a Home / Make an Offer

Step 6: Get Funded

Step 7: Get Insurance / Inspections

Step 8: Sign / Close

Step 1: Determine Your Wants and Needs

One of the keys to making the home-buying process easier and more understandable is planning. In doing so, you’ll be able to anticipate requests from lenders, lawyers and a host of other professionals. Furthermore, planning will help to make the home buying process more efficient.

Initially there are two primary questions that you have to answer: “Do you have a general idea of what you are looking for?” and “Do you have the money?” Whatever your answers, the more you know about the DFW or specific city real estate marketplace, the more likely you are to effectively define your goals. These and many more questions can be quickly answered by a knowledgeable Real Estate Agent.

Step 2: Select a Real Estate Professional

More than 2 million people in the United States have real estate licenses. However, real estate is a tough business with a steep dropout rate, and the result is that only a small percentage of those with licenses actively work with buyers and sellers full time. This site is run by a group of Dallas’/Fort Worth’s Top Realtors, please contact us for more information.

Why?

Buying and selling real estate is a complex matter. At first it might seem that by checking local picture books or online sites you could quickly find the right home at the right price. But a basic rule in real estate is that all properties are unique. No two properties — even two identical models on the same street — are precisely and exactly alike.

Homes differ and so do contract terms, financing options, inspection requirements and closing costs. Also, no two transactions are alike. For example, you may be stopped because of a lack of cash. contact us. In this maze of forms, financing, inspections, marketing, pricing and negotiating, it makes sense to work with professionals who know and are experienced in DFW. With over 60 years of experience, we can help guide you through your purchasing decision.

How?

Across DFW there are hundreds of realty brokerages and real estate agents and brokers and the competition may be intimidating at first but All Star Home Group’s “Survival of the Fittest” arena works out the best for the clients. Many buyers will interview several real estate professionals before selecting one with whom to work and this is a great opportunity to consider such issues as training, experience, representation and professional certifications. Buyers should use all the resources that they have to select their Realtor including referrals, the internet, testimonials and regional experience.

Step 3: Apply for Loan Pre-approval

“Pre-approval” means that you have met with a loan officer, your credit files have been reviewed and the loan officer believes that you can readily qualify for a given loan amount with one or more specific mortgage programs. The lender will then provide you with an approval letter which will show your buying power.

90% of all buyers finance their home, which means that virtually all buyers – especially first-time purchasers – require a loan. More often than not the issue is not getting a loan; it is getting a loan that is right for you: a mortgage with low cost and the best terms.

We suggest that all home buyers begin the mortgage process long before bidding on a home because by meeting with lenders and looking at loan options, you will find which programs best meet your needs and how much you can afford.

Pre-approval also benefits buyers because when you do make an offer on a house, many homes often require buyers to apply for financing within a short time period then forcing buyers to rush into financing agreements that could have otherwise been “shopped”.

Step 4: Shop for Homes

There’s no shortage of housing options in DFW, but with so many choices the challenge becomes finding the property which best meets your needs. The housing market is complicated because the stock of homes for sale in DFW is always in flux. Lists of homes for sale become obsolete within seconds as homes are constantly being bought and sold. This moving target can be a headache so it is best to shop for a home in partnership with your real estate professional.

There’s no shortage of housing options in DFW, but with so many choices the challenge becomes finding the property which best meets your needs. The housing market is complicated because the stock of homes for sale in DFW is always in flux. Lists of homes for sale become obsolete within seconds as homes are constantly being bought and sold. This moving target can be a headache so it is best to shop for a home in partnership with your real estate professional.

This site has the most advanced Multiple Listing Service (MLS) IDX search engine in DFW and you can easily search for homes in your price range or community. The online home search tools on this website is a great place to see what is available in the local market and this information coupled with your Realtor’s knowledge of DFW and knowledge of your needs will expedite the home buying process.

Step 5: Select a Home / Make an Offer

As a DFW Homebuyer, here’s what actually happens. A home has been placed on the market for which the seller has established an asking price as well as other terms. In effect, this is an offer. At this point, you have three choices: accept the seller’s offer and create a contract; reject it and not make an offer; or suggest different terms and make a counter-offer. If you choose this last option, the seller may accept, reject or make a counter-offer.

No aspect of the home buying process is more complex, personal or variable than bargaining between buyers and sellers. This is the point where the value of an experienced Realtor is clearly evident because he or she knows the community, and the current market, has seen numerous homes for sale, knows local values and has spent years negotiating real estate transactions.

Offer Price

You sometimes hear that the amount of your offer should be X percent below the seller’s asking price or Y percent less than you’re really willing to pay. In practice, the offer depends on the basic laws of supply and demand: If many buyers are competing for homes, then sellers will likely get full-price offers and sometimes even more. If demand is weak, then offers below the asking price may be in order.

If you have chosen your DFW real estate professional wisely, this process will be straight forward and relatively pain-free as their experience and relationships work to your benefit.

Step 6: Get Funded

To obtain a loan you must complete a written loan application with a Mortgage broker or bank and provide supporting documentation. Specific documents include recent pay stubs, rental checks and tax returns for the past two or three years if you are self-employed. During the prequalification procedure, the loan officer will describe the type of paperwork required.

See the Mortgage Information section of AllStarHomeGroup.com for more information.

Step 7: Get Insurance/Inspections

A number of inspections are common in residential realty transactions. They include checks for termites, surveys to determine boundaries, appraisals to determine value for lenders, title reviews and structural inspections.

Title insurance: Purchased with a one-time fee at closing, title insurance protects owners in the event that title to the property is found to be invalid. Coverage includes “lenders” policies, which protect buyers up to the mortgage value of the property, and “owners” coverage, which protects owners up to the purchase price. In other words, “owners” coverage protects both the mortgage amount and the value of the down payment.

Homeowners’ insurance: Homeowner’s insurance provides fire, theft and liability coverage. Homeowners’ policies are required by lenders and often cover a surprising number of items, including in some cases such property as wedding rings, furniture and home office equipment.

Flood insurance: Generally required in high-risk flood-prone areas of DFW surrounding rivers and lakes, this insurance is issued by the federal government and provides as much as $250,000 in coverage for a single-family home plus $100,000 for contents.

Home warranties: Home warranties for existing homes are typically one-year service agreements purchased by sellers. In the event of a covered defect or breakdown, the warranty firm will step in and make the repair or cover its cost.

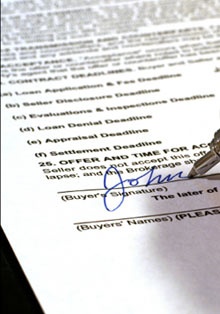

Step 8: Sign/Close

In practice, closings bring together a variety of parties who are part of the “transaction” process. For example, while the history of property ownership has been checked, it’s possible that the records contain errors, unrecorded claims or flaws in the review itself, thus title insurance is necessary. At closing, transfer taxes must be paid and other claims must also be settled (including closing costs, legal fees and adjustments). As a buyer you will have to do relatively little as much of the “legwork” will be handled by your Realtor.

In practice, closings bring together a variety of parties who are part of the “transaction” process. For example, while the history of property ownership has been checked, it’s possible that the records contain errors, unrecorded claims or flaws in the review itself, thus title insurance is necessary. At closing, transfer taxes must be paid and other claims must also be settled (including closing costs, legal fees and adjustments). As a buyer you will have to do relatively little as much of the “legwork” will be handled by your Realtor.

Please ask us any questions regarding the buying process.

Thank you to REALTOR.com for some of the content on this page